case premium segment

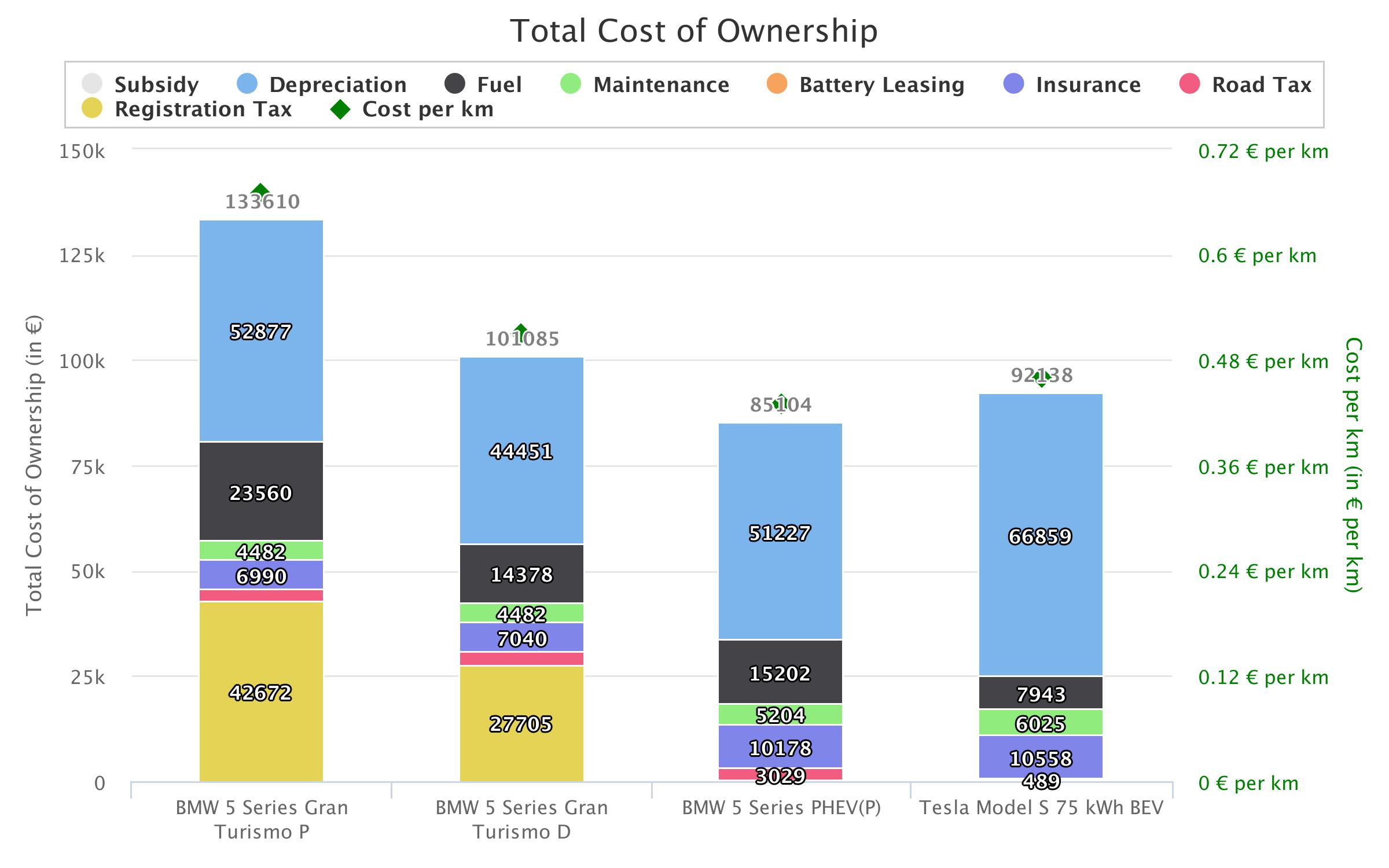

The driver owns his vehicle for a period of 10 years and drives on average 20000 km per year. The assumed petrol and diesel prices are respectively €1.465/l and €1.333/l, for CNG the assumed price is €0.82/kg and the assumed electricity price is €0.27/kWh.

The Western Europe and Scandinavian policy packages are compared.

The main difference in the premium segment is that conventional vehicle owners need to pay more taxes due to their eco-unfriendliness. Even if the conventional vehicles are more taxed and that the fuel costs are higher for the petrol BMW 5 Series, the TCO of the Tesla Model S is still higher (€0.52/km vs €0.48/km). Again, the depreciation plays the biggest role in the TCO of this vehicle segment.

In the Scandinavian case, the tax registration for the conventional vehicles is much higher than in other segments (~€42.000 for the petrol BMW 5 Series and ~ €28000 for the diesel BMW 5 Series). This makes a significant difference in TCO compared to the Western European case. Even if eco-unfriendly vehicles are more taxed in the Western European case, this taxation is not as much a penality as the Scandinavian taxation. The Tesla Model S vehicle has a lower TCO than both conventional vehicles with a cost of €0.46/km compared to €0.67/km for the petrol version and €0.51 for the diesel version of the BMW 5 Series.